Disclaimer:

This website presents the ideas and thoughts of a friend. The information contained within should not be used to make investment decisions. Please contact a licensed certified financial planner before making any financial decisions.

Good Luck, and Good Investing.

There is a lot to know about investing in order to feel comfortable managing your own investments and truthfully you may never feel that you are knowledgeable enough to do it yourself. That being said, even if you choose to use a financial adviser, you should still learn all you can about investing if for no other reason than to be able to keep from being ripped off. I you know nothing about cars or the prices of cars and you go car shopping, there is a good chance you are going to get ripped off. The same may be true in other areans and that includes financial advising.

"Caveat Emptor ", Let the Buyer Beware.

| This article is about dividends. What they are, how they affect your investments and why they are so great inside a 403(b)(7). | |

| This article is entitled "What I Learned When the Bubble Burst." It is about the investing lessons I learned as a result of the tech bubble bursting in 2000 and the slow recovery of the market since. | |

| This article is entitled Great Quotes on Index Investing and is a compilation of quotes by famous (and some not so famous) people in the investing industry. |

The first topics to address are fees and expenses. Regardless of who you invest with and regardless of what you invest in, there are no free lunches. Even at Vanguard where I have my investments, where they are known for low fees, they charge me to do my investing. I am perfectly happy to pay someone to help me with my investing or pay someone to do my investing so long as the cost seems fair. I would pay $20 for someone to change my oil but I wouldn't pay someone $50. The same is true in investing, but the potential consequences of paying too much can be severe, as I will try to explain here.

Fees typically refer to a one time cost you pay for an investment and expenses typically refers to a periodic cost you must bear.

I recently decided to invest $3000 I had in my checking account by sending it to Fidelity to invest in one of their Mutual Funds. They will do the transaction for free. In other words, there are no fees associated with this investment, but there are expenses. The way Fidelity makes their money is by way of an expense ratio. Every Mutual Fund with every investment company has an expense ratio associated with it. If the expense ratio on your fund is 1%, that means that every year Fidelity will take 1% of the assets in your fund. So assuming you put $3000 in on January 1st, and it does well, and on Dec 31st of that year your investment is worth $3300, Fidelity will take 1% of that, or $33 for themselves. You now only have $3267 in you account and that is what you will start the new year with.

Keep in mind, it doesn't really work exactly that way. Fidelity would actually take their 1% gradually over the course of the year but you get the idea.

Expenses effect your investment in two ways.

- When they take their expenses, you lose that money.

- When they take their expenses, the money they take will not continue to grow in your favor. Referring to the example above, because they took their $33 you only have $3267 to grow next year instead of the $3300 so you lose earnings you would have gotten. This is called forgone earnings.

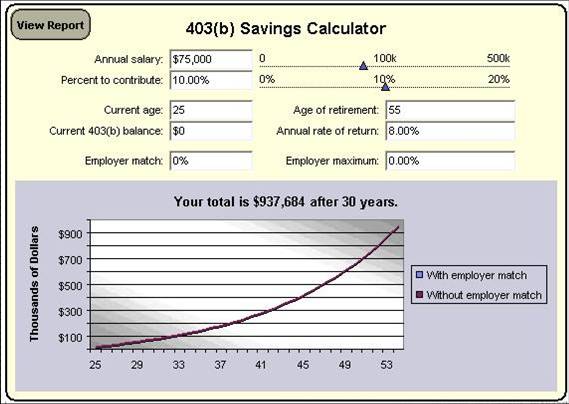

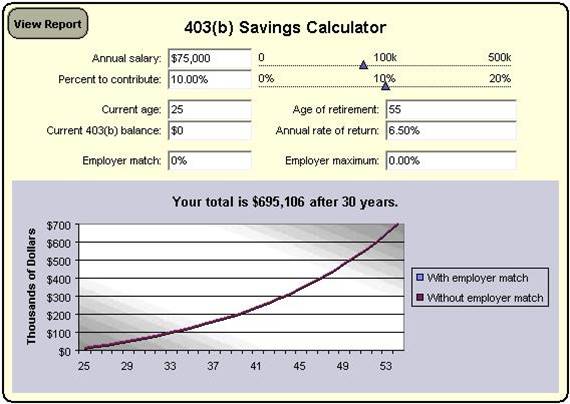

The following examples assume you make $79,000 every year and contribute 10%, or $7,900, into a mutual fund every year for the next 30 years. Keep in mind, your total contribution to this account is $7,900 x 30 = $237,000. The rest of the money in there is a result of your investment growing in value.

The first graph assumes 8% growth, this is below the historical stock market average but as you will learn, past performance is no guarantee of future success and your investments may do better or worse.

The second graph assumes 6.5% growth.

The difference in expenses represents a potential difference of 1.5% in yearly expenses when investing with two different companies. You should check out the expenses at different companies and see how they compare. I used a 1.5% difference as a typical difference between a low-cost provider and a high-cost provider. The point is, you need to find out what the expenses are with any company you invest with and see how those expenses are going to affect the long term growth of your money. You shouldn't trust my graphs, you should do your own calculations.

8% Growth

Being diversified means that your investments are spread out. Not being diversified means that all your investments are in one place. For example, assume you have $20,000 in your retirement account. If you were not diversified, you may have all $20,000 in one